Acuren Corporation (NYSE: TIC)

A Full Analysis of the Upcoming Acuren IPO

Investment Highlights:

Industry Leader: Acuren is a top provider in the TIC industry with essential, recurring services across diverse sectors like oil & gas, chemicals, and aerospace.

Strong Financials: $1.15 billion in 2024 annualized revenue, ~17.5% EBITDA margin, and improving leverage profile (Net Debt-to-EBITDA ~3.2x).

Growth Drivers: Positioned for growth from aging infrastructure, stricter safety regulations, and industrial digitalization trends.

Attractive Valuation: Projected IPO valuation at ~$10/share, with EV/EBITDA of 9.1x and FCF yield of 6.0%, offering room for upside.

Technological Edge: Advanced robotics, phased-array ultrasonics, and data analytics set Acuren apart from competitors.

Proven Leadership: Backed by Sir Martin Franklin, with a track record of successful industrial investments and SPAC deals.

The upcoming public debut of Acuren Corporation, facilitated by Admiral Acquisition Ltd., represents another bold move by Sir Martin Franklin, a SPAC pioneer with a proven track record. This deal, valued at $1.88 billion, positions Acuren, a leader in Testing, Inspection, and Certification (TIC) services, for long-term growth in a critical industrial market. In this article, we break down the key aspects of the transaction, its financial implications, and how it compares to Franklin’s prior SPAC successes, such as the APi Group acquisition.

Overview of Acuren Corporation

Acuren is a market leader in providing asset integrity services to industrial sectors such as oil and gas, chemicals, power generation, and aerospace. The company differentiates itself with advanced non-destructive testing (NDT) methods, proprietary engineering solutions, and in-lab destructive testing capabilities. Its ability to offer compliance-driven and safety-critical services ensures strong customer retention.

Key highlights:

Revenue (2024): $1.1-1.2 billion (YTD annualized)

EBITDA (2024): ~$195-205 million (adjusted for IPO and acquisition; YTD annualized)

Company expects revenue growth of 5-7% CAGR for its industry

Transaction Details

Franklin’s SPAC (Admiral Acquisition Limited) acquired Acuren on July 30, 2024. After the acquisition, Admiral delisted its shares from the LSEG and now plans to IPO the new company Acuren on the NYSE in the first quarter of 2025 under the ticker TIC.

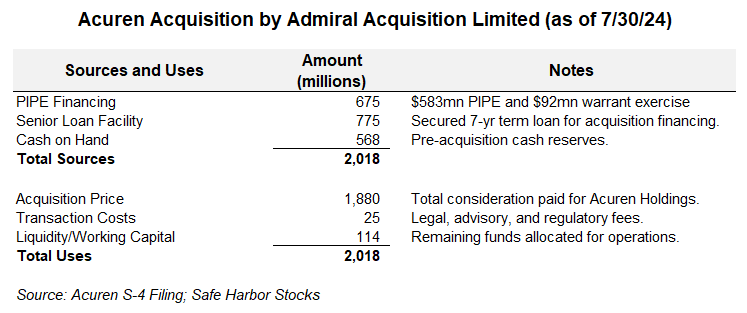

Below are the sources and uses on the date of the acquisition:

Sources of Funds:

PIPE Financing: $675 million includes institutional investments, representing a strong vote of confidence in Acuren’s growth potential.

Senior Loan Facility: $775 million floating secured debt with a 7-year term.

Cash on Hand: $568 million from pre-acquisition reserves.

Uses of Funds:

Acquisition Price: $1.88 billion for ASP Acuren Holdings.

Transaction Costs: ~$24.5 million.

Liquidity: Remaining funds (~$113.5 million) allocated to working capital.

Acuren’s will also transition from the British Virgin Islands to Delaware in order to facilitate a listing on the NYSE. As of 12/20/2024, the company announced it will trade on the OTC market imminently until its NYSE listing in early 2025. As of this writing I do not believe it has begun trading OTC yet (12/26/2024).

Understanding Acuren’s Capital Structure

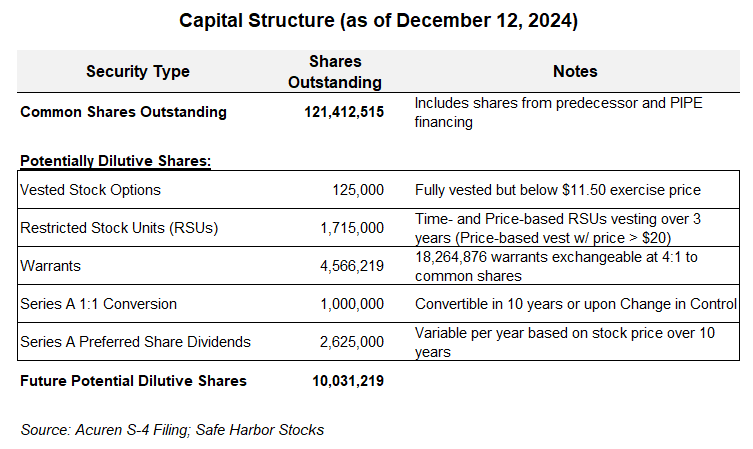

Acuren updated its Schedule S-4 with the SEC on December 12, 2024, and includes details we can use to formulate a projection of its value and capital structure - both today and upon its NYSE listing.

Equity Structure

Acuren possesses a complex capital structure, which is essential to understand in the context of valuation and potential investment. Below, we break down the key components and their implications:

Common Shares Outstanding

Acuren currently has approximately 121.4 million common shares outstanding, which includes the original equity, warrant conversions, and the PIPE offering. This figure should represent the approximate share count when the company lists on the NYSE. However, several sources of potential future dilution are worth considering below.

Vested Stock Options

Acuren has 125,000 options that are exercisable if the stock price exceeds $11.50. Given market conditions and the company's valuation, it is unlikely these options will vest at the time of IPO. This is also a relatively immaterial amount.

Restricted Stock Units (RSUs)

The company has 1,715,000 RSUs, of which 145,000 are already vested. The remaining RSUs are divided as follows:

Time-based RSUs: These vest equally over the next three years, representing 882,500 shares.

Price-based RSUs: These vest if the share price exceeds $20 over the next five years, adding a performance-based dilution component of 832,500 shares.

Warrants

Acuren has 18.26 million warrants outstanding, where every four warrants convert into one common share at an exercise price of $11.50. If exercised, these warrants represent an additional 4,566,219 shares. However, the exercise is unlikely unless the share price exceeds $11.50. I do reflect this scenario below in my valuation analysis.

Series A Preferred shares

The company issued 1 million Series A Preferred Shares, primarily held by Sir Martin Franklin or his entities. These shares carry some potential dilution effects:

Annual Share-Based Dividend:

The 10.5% annual dividend, based on the $25 liquidation preference, equates to $2.625 million annually. The dividend is payable in common shares, and the number of shares issued depends on the share price. For example:At $10/share, the dividend requires the issuance of 262,500 shares.

At $12/share, only 218,750 shares would be issued.

Change of Control Clause:

If Acuren experiences a Change of Control before the 10-year hold period, Franklin is entitled to receive the cumulative dividends upfront in common shares. For example:If redeemed after one year at $10/share, this would amount to approximately 1.05 million shares (10 years' worth of dividends).

In a worst-case scenario, this results in 0.86% dilution relative to the current share count of 121.4 million shares. While this is manageable, investors should carefully consider the timing and impact of this clause.

Conversion Upon Maturity or Change of Control:

Upon a Change of Control or 10 years post-issuance (2034), the Series A Preferred Shares convert to common stock at a 1:1 ratio.

For example, the 1 million shares convert directly into an additional 1 million common shares, regardless of stock price.

Overall, the dividend payments could dilute common shareholders further, especially if the stock price remains low at the time of payment. In a worst-case scenario involving a Change of Control immediately after listing, the cumulative 10-year dividend (approximately 1.05 million shares) and the 1:1 conversion ratio could result in a total dilution of 2.05 million shares. This represents a 1.6% dilution relative to the current share count of 121.4 million shares, which remains modest but should be factored into valuation models.

Debt Structure and Financial Ratios

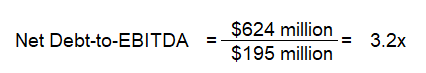

As of the end of Q3 2024 (9/30/2024) Acuren has:

Gross Debt Outstanding: $756 million (including current portion).

Net Debt: $624 million (Gross debt less $132 million cash balance).

Net Debt-to-EBITDA Ratio (July 2024): Reported by company at 3.7x, reflecting initial conditions at the time of acquisition.

Net Debt-to-EBITDA Ratio (December 2024): Using the annualized EBITDA estimate of ~$195-205 million, the updated leverage ratio is 3.2x:

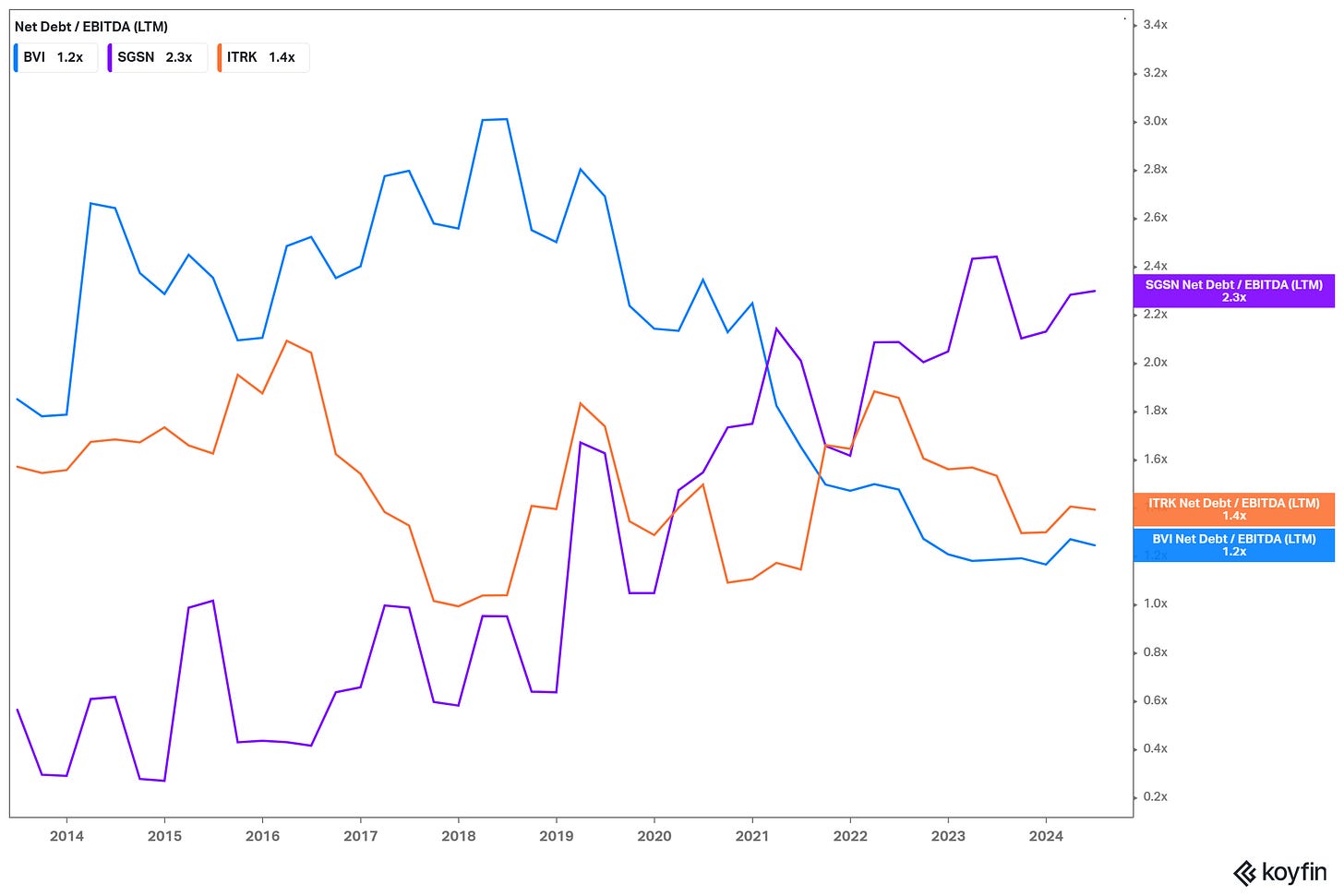

This reduction in net leverage since July reflects improved cash flow, higher EBITDA, and effective debt management during the two months post-acquisition. This level of leverage is within the norm for the TIC industry, which typically range between 2.5x and 3.5x.

According to Koyfin data displayed below, the ratio is higher than some of its public peers, but Acuren does have a plan to reduce this. Part of this is forced due to the terms of the senior credit facility, which requires Acuren pay down its debt each quarter by 0.25% of the original principal balance beginning next week on 12/31/2024.

Insider Ownership

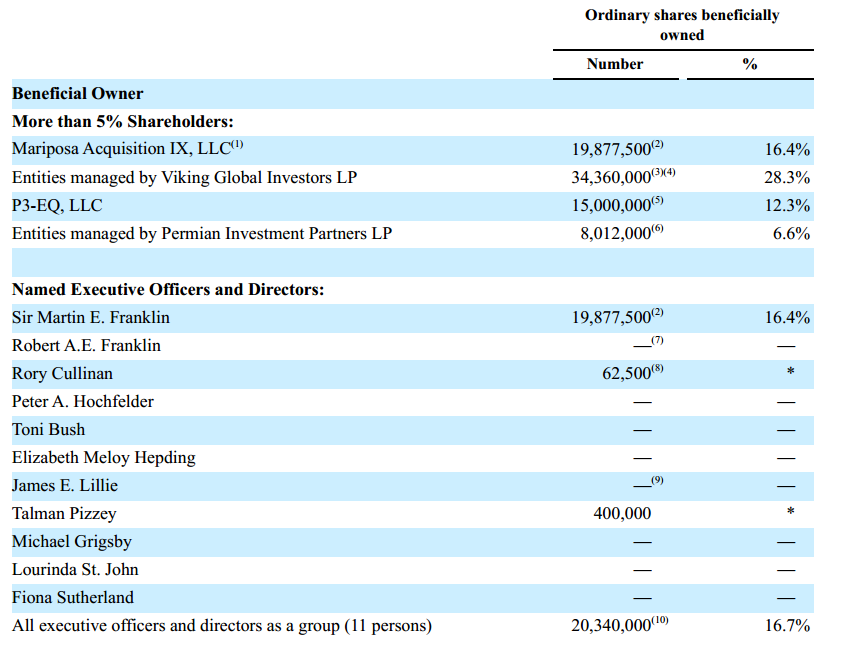

Currently insiders own 16.7% of common shares with Martin Franklin owning the majority of this. In addition, some other private investment firms hold material amounts of shares, as seen below, but they are not insiders. They include Viking, Progeny and Permian Investment Partners - as part of the PIPE financing.

Lockup Restrictions

The preferred shares held by Franklin are subject to a 5-year lockup but his common share interest apparently has no lockup. The three investment firms have a 3-month lockup then require written notice.