Earnings Update: Magnera Q1 2025

Magnera’s First Earnings Report: Can Management Deliver on EBITDA and Deleveraging Goals?

Less than two weeks ago, I published my original analysis of Magnera (MAGN) (linked below). I had purchased my position in Magnera just prior to publishing the write-up. Since then, the stock is up to $20.10 a share, or about a 15% increase.

Magnera reported earnings yesterday and, in this article, I will break down this first official earnings release as a new public company, including how I plan to manage my investment in light of the results. I listened to the earnings call including the Q&A and also reviewed the 10-Q.

Revenue Overview

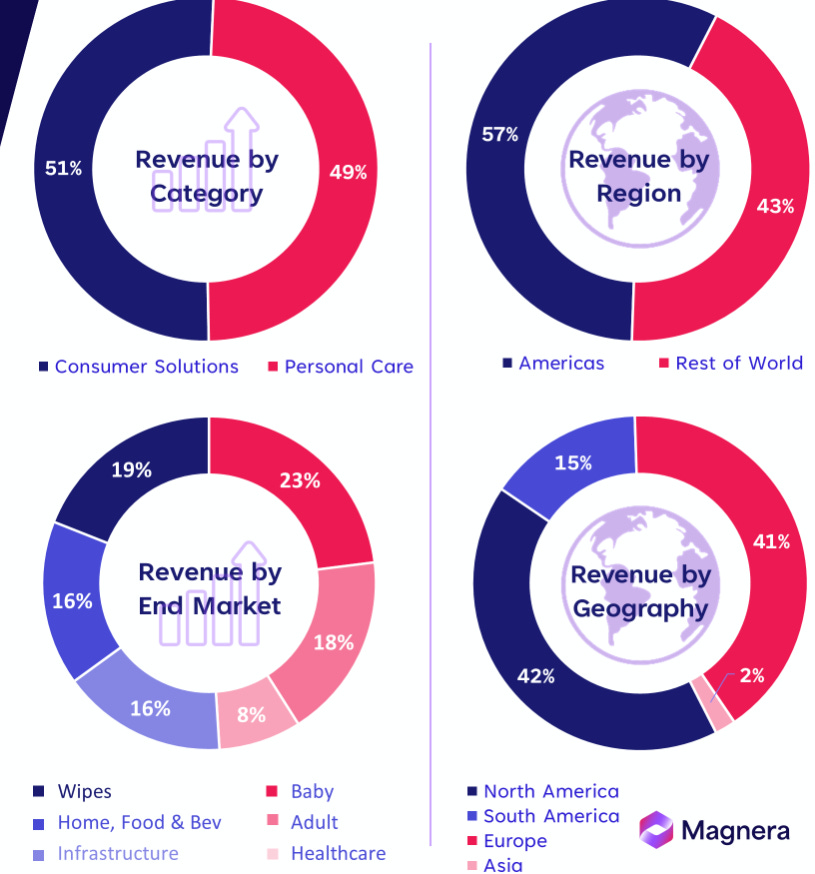

The company’s earnings presentation provides some new breakdowns of revenue for the company, which now includes Glatfelter’s legacy business and the segments spun off from Berry Global. The revenue is balanced and diversified by geography, market and category.

Management estimates, from data gathered by external consultants, the following anticipated consumption growth by end market through 2027:

Wipes: 7%

Home, Food and Beverage: 5%

Infrastructure: 8%

Personal Care: 2-3%

Q1 2025 Highlights

This earnings release is particularly challenging to analyze since the merger closed mid-quarter. Magnera is in the process of integrating the merged business segments and executing on the synergies designed in the transaction.

As mentioned above, management anticipates strong organic growth in its infrastructure and hard surface disinfecting categories. Management is taking action on pricing to continue to offset any cost inflation.

On a YoY comparable basis (adjusted for the merger/acquisition), revenue increased 2% to $702 million with Adjusted EBITDA increasing 8% to $84 million. Adding in another $8 million of proforma adjustments, to reflect GLT’s EBITDA for the entire quarter, Magnera generated $92 million of Adjusted EBITDA.

This Q1 EBITDA annualizes out to $368 million for FY 2025, below the FY 2025 guidance of $385-405 million. However, I will reconcile that for you in the next section.

FY 2025 Guidance

Magnera announced the following guidance for FY 2025:

Adjusted EBITDA: $385-405 million

Adjusted Free Cash Flow: $75-95 million

CapEx: $85 million

Capex

Management guided for a near-term Capex Intensity of approximately 2-3% of sales. This capex will intensify in a year or two, in my opinion, to a range of 3-4%, based on the commentary in the prospectus.

Adjusted EBITDA

There have been some conflicting figures floating around for EBITDA that relate to synergies and also timing (2024/2025). I want to provide an accurate accounting for you here of the Adjusted EBITDA, taking into account the acquisition/merger.

Last summer management, via its prospectus and consultation with JP Morgan, estimated $412 million of EBITDA for FY 2024. It appears this number came in lower due to some cost inflation, FX weakness and softer demand in certain regions like Europe generally and Asian healthcare. I read the reporting as about $383 million of LTM EBITDA excluding synergies (expected in the future).

The company guided to a range of $385-405 million of EBITDA for FY 2025 - a 4% decrease over FY 2024 at the midpoint based on that 2024 estimate, but a slight increase over actual 2024 figures. Management did not call this out, but it is there implicitly in the filings.

Magnera guiding to a mid-point of $395 million for 2025 begs the question of how management can achieve this when it just reported annualized Q1 EBITDA of $92 million ($368 million annualized). There are a couple of reasons the estimate is realistic:

Magnera will benefit from $55 million of synergies earlier than expected, and a good portion of this will be realized during 2025. So, there is a ramp-up of EBITDA over the next three quarters.

The CEO mentioned on the call that the first quarter is also seasonally the weakest for the North American segment.

I would also note that management appears to have quietly reduced its synergy reporting (or perhaps is miscommunicating it) since calling out higher figures like $72 million previously. This leads me to believe there may not be as much synergy as originally thought, and the $55 million is expected over the next 2-3 years gradually.

Net Leverage and EV / EBITDA Consequently

Net Leverage

In the original write-up I mentioned it was too soon to make an educated estimate on 2024 EBITDA so I went with management’s $412 million estimate at the time, not sure if it should have been lower. This yielded a 4.5x net debt-to-EBITDA based on a lower realized EBITDA.

It turns out that net leverage ratio was actually higher, however it’s now down to 4.5x since management has less net debt. I am not so confident, given the recent reporting, that Magnera can achieve a net leverage ratio of 3x within the next 2-3 years. Achieving this depends upon: