The Paper Paradox: How an Overlooked Industry Is Reinventing Security

A leading firm is turning a legacy business into a high-growth security powerhouse.

The Cashless Myth: Why This Business is Thriving

For decades, the rise of digital payments and cryptocurrencies has fueled predictions of a cashless future. With consumers tapping their phones and businesses shifting to digital transactions, many have written off physical currency—and the industry supporting it—as a relic of the past. But what if that assumption is wrong?

Beneath the surface, an often-overlooked company is proving that paper isn't dead—it’s evolving. This firm has taken its deep expertise in securing the most sensitive printed assets in the world and expanded into a much larger opportunity: the fight against counterfeiting, fraud, and digital authentication challenges in a hyperconnected world.

Governments, financial institutions, and global brands aren’t abandoning security measures for physical assets—they’re doubling down. From high-tech currency features to advanced brand protection solutions for luxury goods, pharmaceuticals, and even digital authentication, this company has quietly positioned itself as an indispensable partner in safeguarding trust across industries.

This company represents approximately 3% of my portfolio, making it one of my more significant positions. I believe the market is overlooking a key transition underway that could drive substantial upside in the years ahead. In today’s analysis, I’ll walk through why this opportunity is compelling—and why I’ve allocated real capital to it.

A Business Model Built for the Long Haul

Unlike many high-growth security firms that rely on volatile technology cycles, this company’s foundation is remarkably stable and resilient. With over 45% of its revenue coming from recurring sources (and growing to 50% in the next year), it benefits from long-term contracts with governments and institutions that must continue investing in security solutions. Its most recent quarterly results reflect this momentum:

Strong revenue growth of approximately 12% year-over-year (3% organic and 9% from acquisitions), with international markets playing a growing role.

A free cash flow conversion ratio around 100%, demonstrating operational efficiency and responsible management.

Operational improvements driving margin expansion (27% EBITDA), thanks to a proprietary system focused on continuous efficiency gains.

And yet, the market is still largely underestimating the transformation happening within this business. The share price sits 25% below the analyst consensus and the street neglects to include in 2025 EPS an important upcoming acquisition that adds 5% to EPS at least. While many investors still associate the company with its historical roots, the reality is that it’s rapidly evolving into a technology-driven security leader, tapping into powerful secular trends in authentication, anti-counterfeiting, and digital security.

A Quiet Yet Powerful Opportunity

This company isn’t chasing headlines with splashy technology hype. Instead, it’s executing a disciplined strategy—leveraging its unmatched reputation in securing physical assets to expand into fast-growing adjacent markets, including:

Government and currency security: Providing advanced features for banknotes used worldwide.

Brand authentication: Partnering with global brands to protect against counterfeiting in luxury goods, pharmaceuticals, and industrial applications.

Digital and smart packaging security: Using cutting-edge solutions that merge physical and digital authentication technologies.

With a strong balance sheet, disciplined capital allocation, and a proven M&A strategy, this company is quietly shaping the future of security—while many investors still see it as just a legacy player.

But here’s the twist: it isn’t standing still. A major transformation is underway, and the market has yet to fully price in its shift toward high-margin, tech-driven security solutions. The company’s roots trace back 224 years - and earlier during the American Revolution! Today’s leadership highly values the founding roots and it’s again showing that it knows how to adapt.

Want to know the name of this company and how its next moves could unlock even greater shareholder value?

Our premium report below provides a deep dive into its financials, strategic positioning, and how investors can capitalize on this overlooked opportunity. Subscribe now for full access. I spend approximately 20 hours on average preparing each of these deep dives and I believe you will find them interesting and helpful.

Crane NXT: A Misunderstood Leader in Currency and Authentication Technology

A Trough Before the Next Growth Phase?

Crane NXT (NYSE: CXT) is currently navigating a period of temporary headwinds, primarily due to a planned slowdown in its U.S. currency business as it retools its equipment for the next series of banknotes. While the near-term numbers appear muted, the company is actively repositioning itself for a stronger future, driven by strategic acquisitions, an expanding presence in security and authentication solutions, and increasing revenue from recurring sources.

For investors willing to look beyond the short-term dip, Crane NXT offers an interesting opportunity. Its long-standing dominance in currency security technology, bolstered by proprietary micro-optics, is being leveraged into high-growth applications beyond physical cash. Meanwhile, its latest acquisition, De La Rue Authentication Solutions, is expected to be significantly accretive to earnings—a fact that Wall Street estimates appear to be overlooking.

The disconnect between short-term financial noise and long-term fundamental strength presents a compelling case for a closer look.

Short-Term Weakness, Long-Term Strength

At first glance, Crane NXT’s numbers from its fourth quarter and full-year 2024 earnings release don’t look spectacular. While full-year sales grew 7% year-over-year and adjusted EPS came in at $4.26, its U.S. currency segment is set to decline by 20% in 2025 due to temporary downtime. As a result, CXT guided for flat to low-single-digit sales growth in 2025.

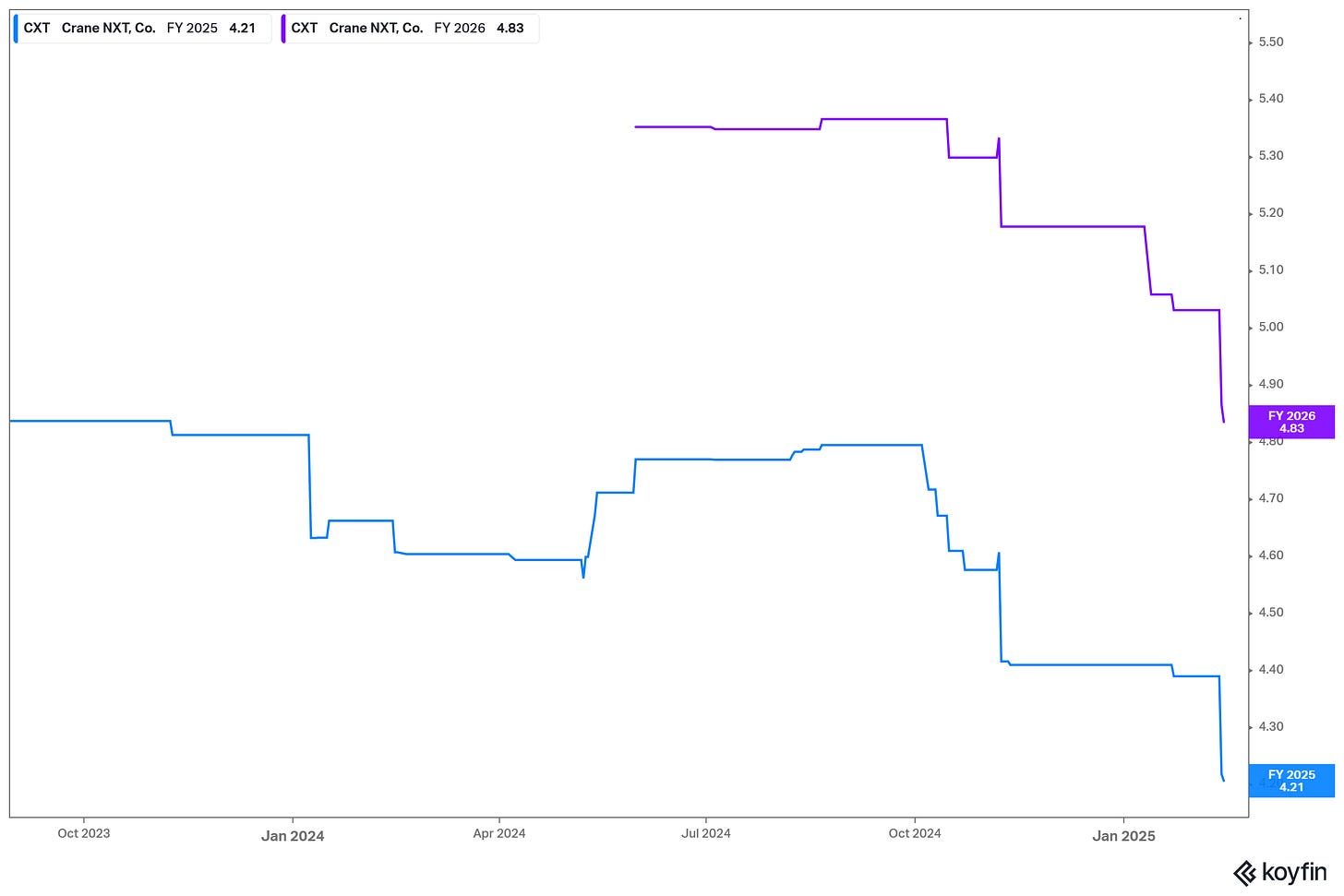

This might explain the lukewarm analyst reaction, with consensus estimates settling at $4.21 EPS, on the lower end of the company’s guidance of $4.00 to $4.30, and down from $4.39 just prior to earnings reported last week.

Are FY 2025 Earnings Being Overlooked?

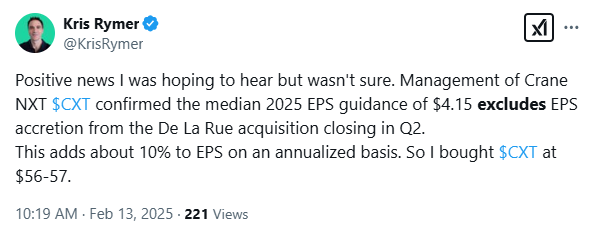

Investors paying attention to the earnings call would have noticed a key detail: this guidance does not yet include any contribution from the De La Rue Authentication acquisition, expected to close in Q2.

Management stated that De La Rue is expected to contribute an implied $0.20 to EPS in the second half of 2025, representing a 4.6% bump (9.2% annualized) to the company’s median guidance of $4.15 per share. I backed into this implied EPS boost by using management’s disclosure late last year of De La Rue’s select financial performance for 2024.

From the earnings call:

Moving now to 2025 guidance on Slide 11. And just a reminder that this guidance does not include the anticipated close of the De La Rue Authentication transaction in Q2 or any impact of potential new tariffs.

This means that unless analysts revise their estimates, the market may be underpricing CXT’s forward earnings potential. Management is perhaps just being conservative given the uncertainty around tariffs, which we can discuss later. Here is the tweet I posted while listening to the CXT earnings call last Thursday.

The temporary impact from the U.S. currency production stoppage, combined with an overlooked earnings boost from acquisitions, creates an opportunity for investors willing to take a longer-term perspective.

The Expanding Moat: Micro-Optics and Authentication Tech

Crane NXT has positioned itself for significant shareholder value creation through a focus on three core pillars: (1) Secure, (2) Detect and (3) Authenticate. The company operates through two business segments.

Security & Authentication Technologies (42% of Sales): Provides solutions for securing physical products including banknotes, consumer goods and industrial products. Also provides brand protection and authentication solutions.

Crane Payment Innovations (CPI, 58% of Sales): Provides electronic equipment and software with various detection and sensing technologies for applications including verification and authentication of payment transactions.

One of the most overlooked aspects of Crane NXT is its dominance in micro-optics technology, a critical component in high-security applications.

Micro-Optics: More Than Just the $100 Bill

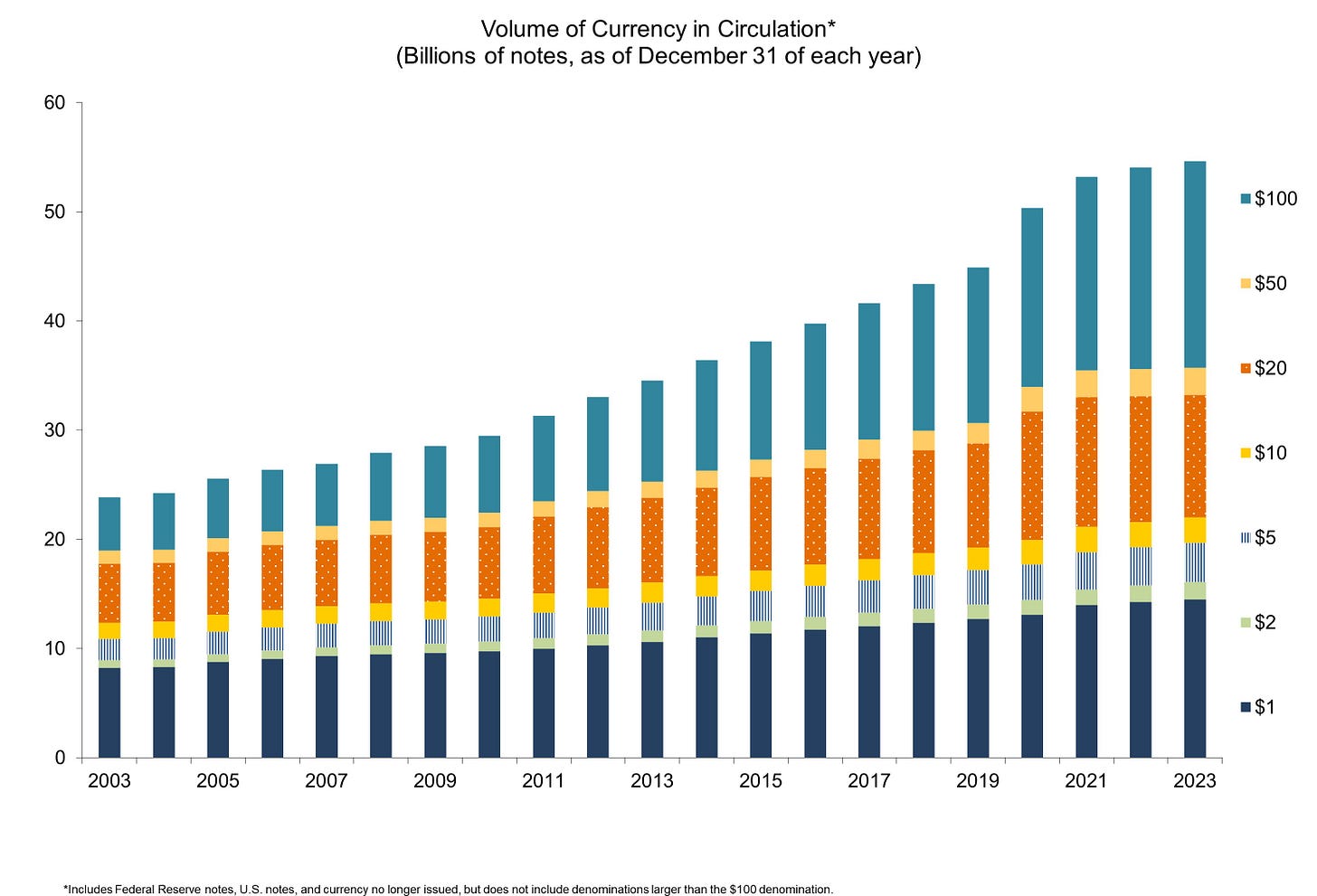

CXT’s proprietary micro-optics security features—which create dynamic visual effects used to prevent counterfeiting—are currently only integrated into the U.S. $100 bill. However, demand for this technology is rising globally.

Management highlighted that in 2024 alone, they secured 13 new currency design wins, incorporating micro-optics into banknotes across multiple countries. This is well within their historical 10–15 new contract wins per year, a trend expected to continue.

The Federal Reserve expects a 3% CAGR of banknotes in circulation through 2030, driven by inflation and demand for physical cash due to natural disasters or global uncertainty. Below this chart from the Federal Reserve shows the trend of currency in circulation over the last 20 years.

Crane has been the sole supplier of US Currency paper since 1879! Moreover, greater than half the revenue from Crane banknotes is derived from foreign governments. Data from Crane shows that countries selecting Crane micro-optic technology for its banknotes increased at a 14% CAGR to more than 50 countries and central banks.

Below is a four-minute video on Crane Currency’s security feature called Motion Surface if you are interested in learning more.

Beyond Physical Cash

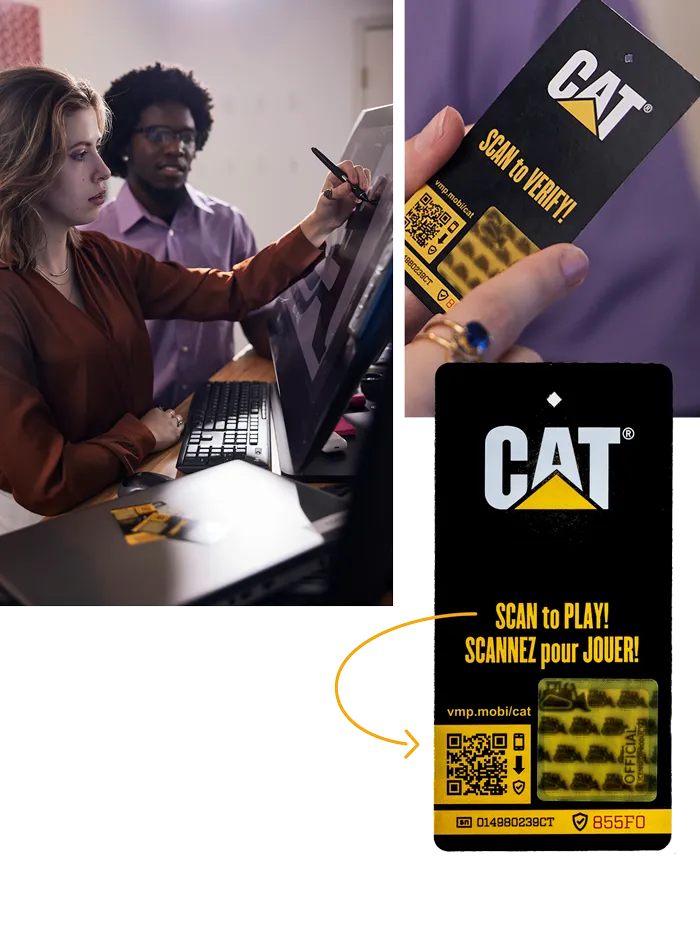

Beyond physical cash, CXT is expanding this technology into product authentication and brand protection, a move accelerated by its OpSec Security acquisition. In a recent milestone, Crane NXT landed its first luxury brand client, integrating micro-optic security labels into high-end perfume packaging, along with digital authentication and brand protection services.

This is a major step toward building a more resilient, recurring-revenue business. Crane NXT has more than 130 patents and now more than 1 trillion SKUs protected. Below is a picture and short video animation illustrating some of the technology for consumer brands.

Acquisition Strategy

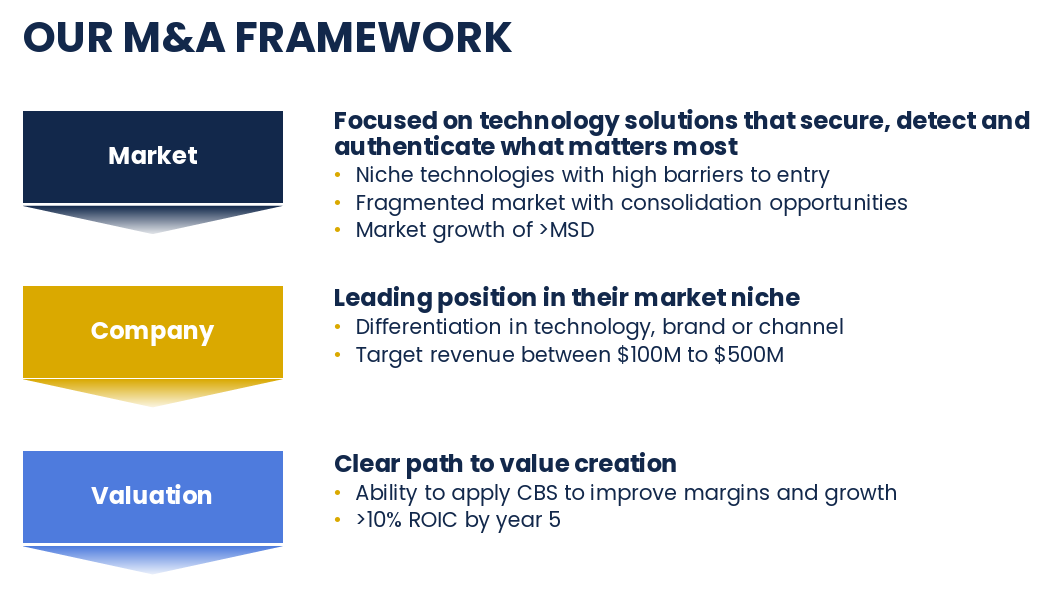

Let’s introduce CXT’s acquisition strategy with its own M&A Framework to start us off. Management is focused on the authentication technologies market which is growing at mid-single-digits (MSD) or higher. The team targets a 10%+ ROIC by year five but accretive EPS within year one.

Management laid out a 5-year target of $3 billion in sales by 2028, from $1.3 billion in 2023. That’s an 18% CAGR. Two years after the spin-off and announced target, the required revenue CAGR is somewhat higher, but CXT has another big acquisition closing in Q2 2025 plus temporarily suppressed revenue in 2025 due to the US currency equipment retooling.

Crane has grown revenue by 15% CAGR since 2013 accelerated by successful acquisitions, accompanied by margin expansion during the same period. Thus, I have confidence the company can achieve its goals over the next few years. Since 2013, Crane NXT increased its operating margin to 28% from 13%.

Next Acquisition: DeLaRue Authentication Solutions

CXT will close on its next acquisition of DeLaRue in Q2 2025. The company has $130 million of annual sales and a 20% EBITDA margin. It checks all three boxes in Crane’s M&A Framework above, including 95% recurring revenue. DeLaRue offers technology and solutions for identification security, brand protection and traceability of government tax revenue.

DeLaRue is actually a publicly traded company on the London Stock Exchange (LSE: DLAR) so I pulled their financials. DLAR’s authentication segment, which CXT is purchasing, grew revenue 12.5% in its last FY and has strong margins as suggested by CXT. DLAR just renewed the final of four of its significant multi-year authentication contracts with a combined expected contract value over $185 million - or 143% of its annual revenue. The transaction was not cheap at about a 14x EV/EBITDA but CXT has a good history of execution.

De La Rue will be combined with CXT’s most recent acquisition - OpSec Security.

OpSec Security

Coincidentally, OpSec also had 2024 revenue of $130 million and an estimated 15% EBITDA margin. OpSec provides authentication solutions for physical consumer products as well as online brand protection across various end markets.

Another benefit to these adjacent acquisitions is the operational and commercial synergies upon consolidation. The $3 billion authentication technologies market is fragmented, and Crane has shown it can integrate roll-ups like this successfully.

Benefits of M&A: A Resilient Portfolio

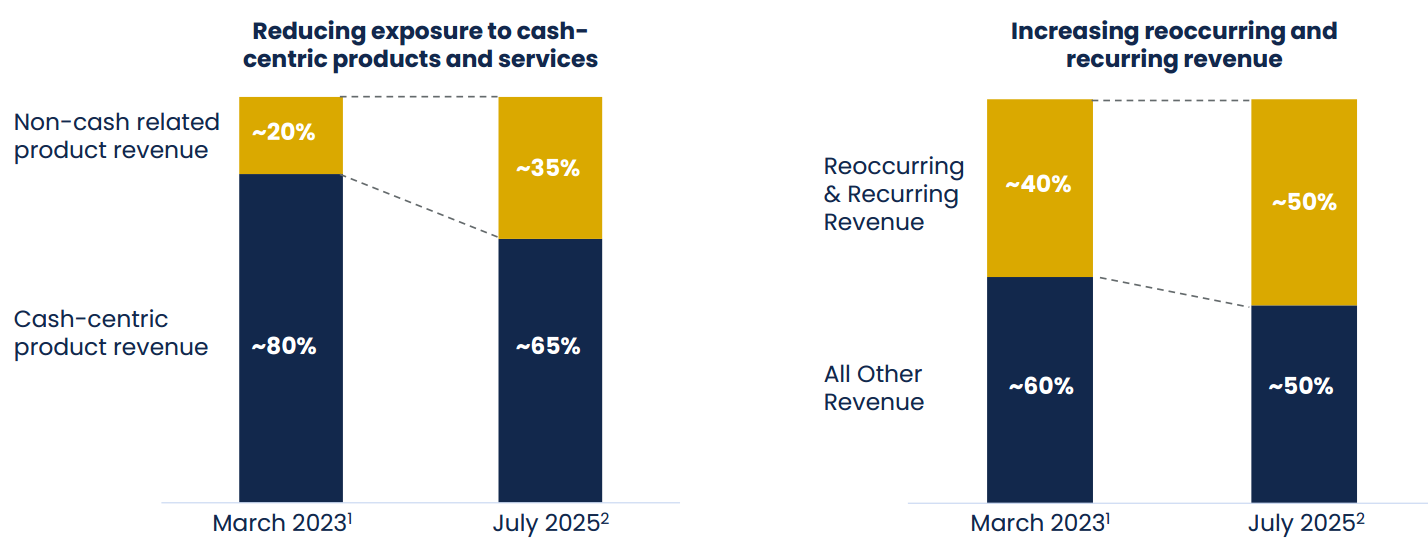

One underappreciated aspect of CXT’s robust M&A pipeline is its impact on Crane NXT’s business mix. The company has actively been reducing its reliance on physical cash-related products and increasing its share of recurring revenues. Upon closing of the De La Rue deal next quarter, management expects:

35%+ of total revenue to come from non-physical cash businesses.

50%+ of revenue to be recurring from long-term authentication contracts.

This transition improves CXT’s business quality and valuation multiple, yet the market has yet to fully price this in.

One final example on the margin expansion record for its acquisitions: CXT has a proven record of purchasing companies, on average, with a pre-acquisition margin of 7% and raising that to 10% within three years, and 24% within 8 years.

Here’s a few examples of execution on their acquisitions:

MEI: Acquired in 2013 and a 12% ROIC within 5 years

Crane Currency: Acquired in 2018 with a 12% ROIC within 5 years

Cummins Allison: Acquired in 2020 with a 27% ROIC by Year 3

Capital Allocation & Shareholder Returns

One of Crane NXT’s strengths is its disciplined capital allocation strategy, balancing:

M&A: Strategic bolt-on acquisitions in high margin authentication/security.

Dividends: Raised at a10% CAGR over the last two years since the spin-off.

Debt Management: Maintaining net leverage under 2.3x post-acquisition.

Attractive Debt Profile: Majority of debt is long-term maturity between 2036-2048 at a WACD of 5.0%.

Management invests about 2.5-3.0% of sales per year into organic growth through new product development and added capacity. It pays approximately a 1% dividend (~16% payout ratio) with the remainder going to M&A and opportunistic share repurchases. CXT does have a robust pipeline for authentication technology companies, so it’s largely been allocating to acquisitions.

Return on Invested Capital (ROIC) as calculated by Koyfin has run about 14-15% although I have not conducted my own analysis. There seems to be enough of a track record and execution to render this calculation insignificant.

Furthermore, CXT has exhibited solid free cash flow conversion of around 100% on average for the last several years. I estimate the company’s current FCF yield to be approximately 7-8% based on today’s $59 share price. FY 2024 FCF conversion was a bit lower earlier in the year, but this is expected due to some timing issues around the US Currency equipment cycle.

How Does CXT Stack Up Against Competitors?

Crane NXT operates in a niche but highly defensible space. Its closest competitors include SICPA (private), Authentix (private), and De La Rue (LSE: DLAR, pre-acquisition).

Authentix

Authentix is probably the closest competitor to CXT today in authentication solutions. The company is owned by Bluewater, a private equity group, since 2017. Authentix is attempting to roll up the authentication industry too with its recent acquisition of Nanotech Security Corp, its fifth acquisition since becoming a Bluewater portfolio company.

It is worth noting that the Nanotech acquisition is small by comparison with Currency News reporting the purchase price to be approximately $10 million.

Given the private equity ownership of Authentix, I feel more comfortable owning CXT as PE-backed companies tend to leverage higher and also distribute capital to its LPs sooner. CXT has the benefit of a more permanent investor base in the public market. It is using the majority of its cash flow to acquire strategic companies. Kevin McKenna, the CEO of Authentix, recently conducted an interview with Currency News if you are interested learning more about this competitor.

SICPA

There is not as much information available on SICPA but you can read the transcript of an interview conducted by the ITSA with an executive of the company. It is a Swiss company that specializes more so in provision of the security inks for currency printers. This is good news for CXT investors as SICPA does not appear to be as direct of a competitor. SICPA also works on some integrated security solutions in Europe for labeling related to excise taxes.

Investment Case: What’s the Market Missing?

Given the temporary currency slowdown and DeLaRue earnings boost not fully priced in, Crane NXT appears undervalued.

Key Takeaways

✅ Short-term numbers are temporarily depressed due to the U.S. currency transition, but post-2025 earnings should normalize higher. I expect 2026 EPS to be around $5.20 a share assuming retail stabilizes in the Crane Payment Innovations (CPI) segment in addition to the US Currency printing re-launching for the 2026 series bills.

✅ De La Rue acquisition adds 5% to 2025 EPS and 10% annualized—yet analysts have not fully factored this in. That takes the 2025 EPS to about $4.33 a share - higher than the $4.15 a share midpoint conservatively guided by management.

✅ CXT is shifting to a higher-quality, more recurring-revenue business model, improving its valuation profile. Management expects to maintain, not expand, its company-wide 27-28% EBITDA margin. However, the acquisitions involve margin expansion and become more accretive to EPS.

✅ The stock may be mispriced based on underappreciated tailwinds in authentication, micro-optics, and product security.

Risks to Consider

❌ Delayed integration risks with OpSec and De La Rue. I almost hesitated to put this as a risk because I have great confidence in the team to execute.

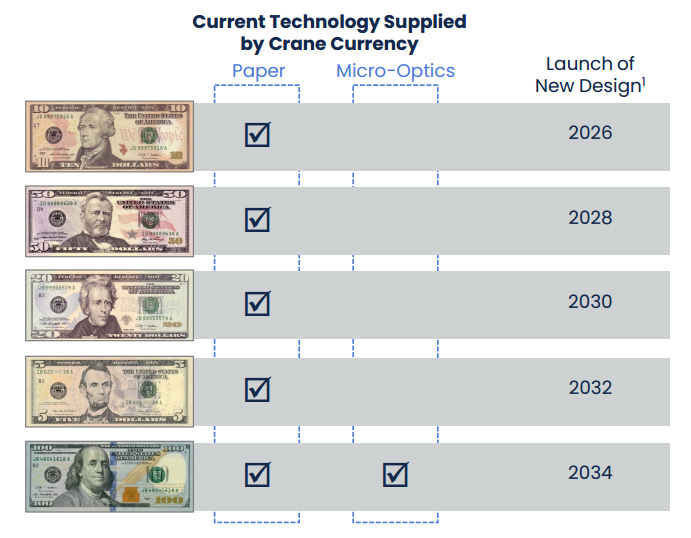

❌ U.S. currency business remains cyclical — growth depends on future redesign cycles. CXT is diversifying its business, and these design cycles are long and planned years in advance. The graphic below shows the upcoming new designs and series printing reported by the Bureau of Engraving and Printing (BEP).

❌ Global macroeconomic factors could slow demand in authentication/security segment. I see this as more of a risk in the consumer product markets.

Separately, in the CPI segment, management provided an unfavorable outlook for the retail market projecting a HSD decline in sales for 2025, due to declines in OEM orders. However, retail only comprises 15% of the CPI segment, or 8.5% of company-wide sales. The other markets are expected to experience LSD to MSD growth.

❌ Backlog declined significantly for the CPI segment, down 33% YoY. However, the book-to-bill returned above 1x in Q4, with a sequential 10% increase QoQ. This backlog decline was also expected due to customer destocking in the gaming market. Backlog is now within normal longer-term expectations.

❌ Tariffs were mentioned by management in the earnings call related to 2025 guidance. The company noted that their earnings guidance excludes the positive impact of the DeLaRue acquisition yet also assumes no impacts from tariffs. I don’t think it’s helpful to read into tariffs anyway as an investor.

These companies are far too large with global manufacturing footprints and supply chains to be able to analyze it, plus management teams tend to be good at adapting to such changes in government policy. You can see the slide on CXT’s global footprint. I assume it is balanced enough where tariffs are relatively neutral.

Final Thoughts: A Stock to Watch in 2025

Crane NXT presents a classic case of near-term headwinds masking long-term value. The stock is not necessarily undervalued as it trades at around a 13.9x forward P/E. However, I like this stock here as an opportunity to hold for the long-term at a fair valuation with 10%+ earnings growth potential. Investors willing to look beyond temporary currency-related weakness may find an attractive setup, especially given:

Underappreciated earnings accretion from De La Rue.

A strengthening recurring revenue base.

Technological leadership in authentication and security solutions.

At current valuations, this could be a well-timed entry point ahead of a 2026 rebound.

Thanks for being part of the Safe Harbor community! Follow me for more insights: LinkedIn | X (formerly Twitter) | Instagram | YouTube

Disclosure: This information is provided for informational purposes only and should not be considered a solicitation or recommendation to buy or sell any securities. The author or entity providing this information may hold positions in the securities discussed. This is not investment advice.

Thanks for your comments. Good point about the owned real estate.

And The Crane Fund (13% ownership) is interesting. Over 100 years of history helping former Crane employees.

Agree on the acyclical nature of the business perhaps excluding some of the small consumer end markets.

Thanks for sharing. Certainly an overlooked business. Also worth mentioning they own 2.5M SF of their own manufacturing facilities.

Presumably the 20% decline in 2025 in the current business is temporary and will kick back in in 2026.

Backing into the SAT revenue (before OpSec contributions) gets you to $528M. Let's say 40% of SAT business is US Bank Notes, so $211M and 20% impacted so $42M at 20% operating margin, so $8.5M or $0.15 EPS.

Normalized earnings: $0.15 EPS (assumes US Bank program runs at full capacity, before upside from 2026 program) + $0.40 EPS (annualized De La Rue) + $4.15 EPS mid-point guidance = <12 P/E @ $55/share today.

Ignores the fact this business underspends D&A (3% of capex on sales) by ~$40M annually. Would say this is largely an acylical business. Think we will see organic tailwinds in this space and they are the market leader.

Also nice to see 15% insider ownership. Worth owning some and will add if it continues to drop (Q1 earnings expected to be light per management).