Earnings Update: Amentum Q1 2025

Strong Execution, Growing Backlog, and Strategic Expansion

This article is an update on Amentum’s earnings release from February 5, 2025. For reference, you can view previous write-ups of Amentum below:

Amentum (NYSE: AMTM) reported its latest earnings results for Q1 2025, followed by its conference call. The company reaffirmed its FY 2025 guidance while showcasing strong bookings, margin expansion, and commercial growth momentum. Below is a structured breakdown of the key takeaways.

I created a YouTube channel for Safe Harbor Stocks and recorded my first video on it today discussing the results in this article. I would be happy to have you subscribe to the channel and hear your feedback.

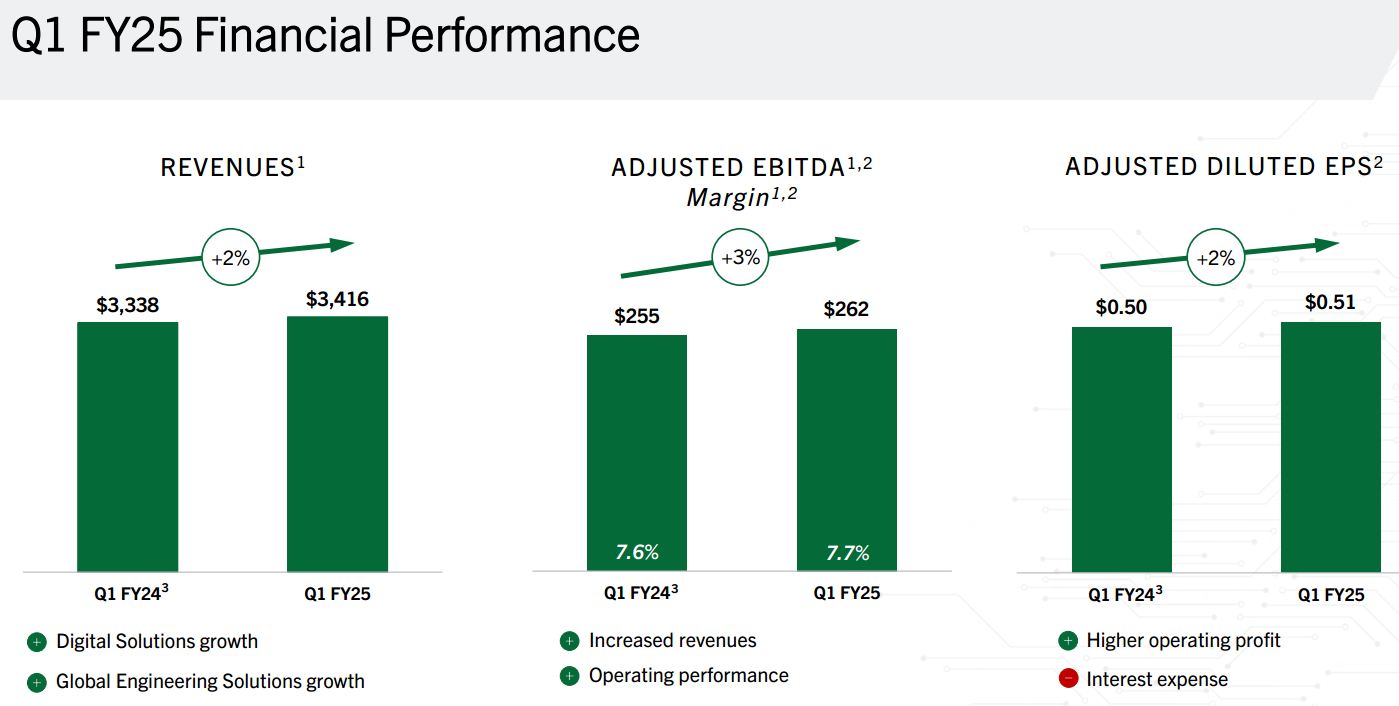

First, briefly listed below are the latest quarterly results.

Financial Highlights & Debt Strategy

Net Debt-to-EBITDA improved slightly by 0.1x to 4.0x, driven by EBITDA margin expansion and a slightly higher cash position at quarter-end.

No debt paydown this quarter, but management reaffirmed its goal to reach 3.0x Net Debt-to-EBITDA by FY 2026. There are contractual principal payments due, and management reiterated its top capital allocation priority to pay down its debt which alone can provide EPS accretion to the tune of about 7-8% CAGR over the next two years.

Free cash flow (FCF) is expected to be strongest in the back half of the year.

Bookings, Backlog, and Growth Opportunities

Book-to-Bill Ratio: Reported at 1.1x overall but a stronger 1.5x including unconsolidated JVs, a key contrast to some peers reporting weaker BTB this quarter such as for BAH.

New Business Wins: Two-thirds of new awards came from new business, rather than recompetes. This is a positive sign for business development.

Segment Strength: Both Global Engineered Solutions and Digital Solutions reported a book-to-bill ratio above 1x, highlighting solid overall demand.

Key New Awards & Future Pipeline

$3 billion DOE West Valley JV Award: A 10-year project to decommission nuclear facilities using advanced technology solutions and unmanned robotics. Assuming a 50/50 JV, this single-award IDIQ can add up to ~1% of annual revenue but is not yet in revenue. Remember these IDIQs are also excluded from backlog.

Private Sector Expansion: Amentum secured over $400 million in awards from Fortune 500 companies in communications and infrastructure modernization. The merger, doubling the size of the company allows AMTM to cross-sell and bid on contracts with a larger scope - and more margin.

Bidding Activity: Amentum submitted $12 billion in bids during Q1 and targets $35 billion in total bids for FY 2025.

Enterprise Contract Focus: The company is actively pursuing 15+ opportunities over $1 billion, enabled by cross-sell opportunities from the merger. These projects if awarded will also drive EBITDA margin expansion.

Segment Performance & Profitability

Digital Solutions grew 5% YoY, excluding the impact of Cytec (previously announced).

Global Engineering Solutions saw 3% YoY growth.

Merger Synergies: Management mentioned it sees the company realizing $30 million in annualized run-rate cost savings from integration efforts of the merger for FY 2025 on track with previous guidance.

EBITDA Margin Outlook:

Margins grew from 7.3% to 7.7% in FY 2024.

Expecting further expansion to above 8% in 2026+.

Larger $1 billion+ awards will help expand margins over time.

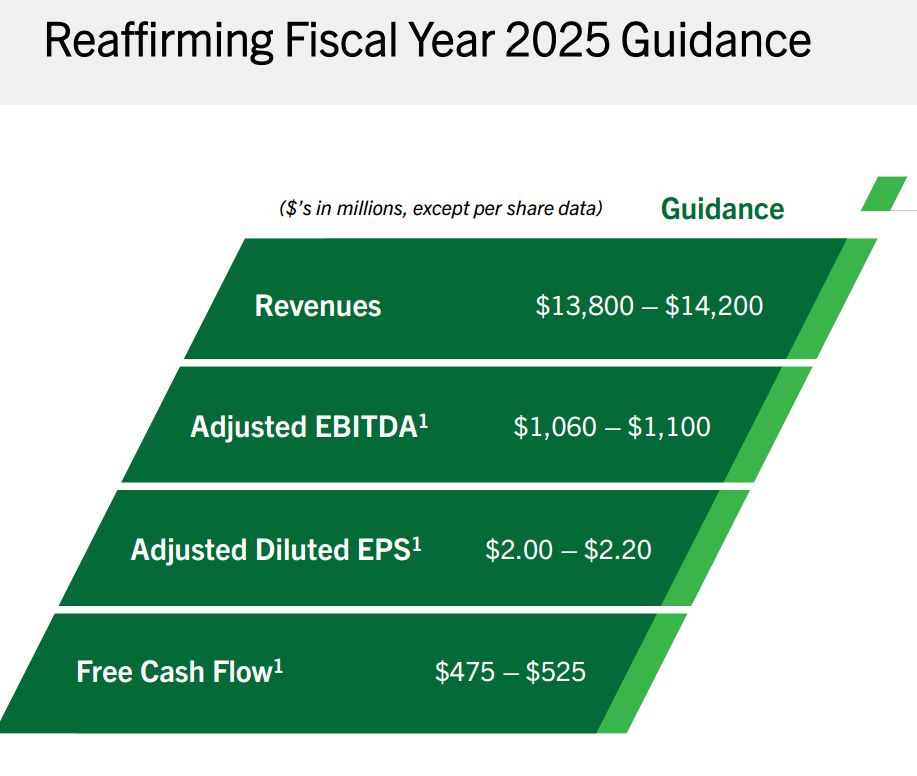

FY 2025 Guidance Reaffirmed

Amentum reiterated its FY 2025 guidance (below) from last quarter seeing no material negative impact from the new administration and its initiatives. Based on today’s closing price, the company trades at the following metrics:

9.0% FCF Yield

10.8x Forward P/E

9.0x EV / EBITDA Ratio

Management built into its guidance (below) a 1% negative revenue impact from new administration policies, adding conservatism to the outlook potentially from foreign aid work. Just as important, management excludes any new shorter-term contract opportunities it is seeing from new US government actions, for example in supporting the new administration’s actions around the border and the world.